Transaction Cost Analysis: Behind your TCA and why it could have been called TCDA

The TCA examples in this article will refer predominantly to equity markets although a subsequent piece will expand to include the growing TCA use and differing limitations across other asset classes.

In the early stages of TCA adoption firms tend to run reports, check for outlying executions, investigate those outliers then sign off the report and file it. Some firms go on to measure the trading desks performance from an IS (implementation shortfall) perspective or versus VWAP but most of their effort would go at looking at executions that were wide of their benchmark.

Some firms use TCA to measure the market timing of their Portfolio Managers too.

This report is intended to take the non TCA expert behind the scenes in a non technical way and increase the understanding of what the figures may be saying, and what can be done to improve them.

Incidentally the reason that most early TCA was equity based is because the single most important factor in TCA analysis is data (Hence why it could have been called TCDA). Time stamped tradable execution data is actually the driver of TCA and it’s been more available and reliable in equity markets pre and post MiFID than it has in pretty much any other asset class.

It’s no coincidence that as electronic order routing, price discovery, trade reporting and settlement increases across asset classes and they become more “exchange like” so too does increased measurement via TCA.

The purpose of this report is to explain some of the results you might see from a standard TCA report, to explain why they might be occurring and where you might look to quantify and/or change them.

Whilst it gets to issues and functionality that the average buy side institution may have little or no control over ultimately the idea is to educate the reader because educated individuals generally make better choices. If this report leads to better understanding of how historic TCA data can be used to improve future execution performance it will have achieved its aim.

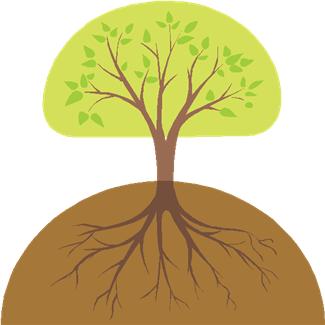

I have developed the idea of a TCA Tree to illustrate the constituent parts.

The TCA examples in this article will refer predominantly to equity markets although a subsequent piece will expand to include the growing TCA use and differing limitations across other asset classes.

In the early stages of TCA adoption firms tend to run reports, check for outlying executions, investigate those outliers then sign off the report and file it. Some firms go on to measure the trading desks performance from an IS (implementation shortfall) perspective or versus VWAP but most of their effort would go at looking at executions that were wide of their benchmark.

Some firms use TCA to measure the market timing of their Portfolio Managers too.

This report is intended to take the non TCA expert behind the scenes in a non technical way and increase the understanding of what the figures may be saying, and what can be done to improve them.

Incidentally the reason that most early TCA was equity based is because the single most important factor in TCA analysis is data (Hence why it could have been called TCDA). Time stamped tradable execution data is actually the driver of TCA and it’s been more available and reliable in equity markets pre and post MiFID than it has in pretty much any other asset class.

It’s no coincidence that as electronic order routing, price discovery, trade reporting and settlement increases across asset classes and they become more “exchange like” so too does increased measurement via TCA.

The purpose of this report is to explain some of the results you might see from a standard TCA report, to explain why they might be occurring and where you might look to quantify and/or change them.

Whilst it gets to issues and functionality that the average buy side institution may have little or no control over ultimately the idea is to educate the reader because educated individuals generally make better choices. If this report leads to better understanding of how historic TCA data can be used to improve future execution performance it will have achieved its aim.

I have developed the idea of a TCA Tree to illustrate the constituent parts.

This is designed to give the reader an understanding of what is going on beneath the surface when one looks at the summary page of a TCA report, which is generally an IS or VWAP summary.

IS – Implementation Shortfall

The leaves of the tree are what you see, in the first instance this is often how the trader and the trading process are perceived. Implementation Shortfall is defined as the difference in price from the point when the decision to trade is taken to the point after the trade has been executed. Its measurement can be refined for variables such as liquidity.

VWAP – Volume Weighted Average Price

These are the branches that support the leaves, the VWAP for a period is often used to define execution quality, so executions which over or under perform the benchmark might be perceived as changing the tree's size. Even for a tree with the same number of leaves the greater area covered by a tree with better branch structure might be likened to an improvement in execution quality.

Momentum and Reversion

Essentially as we travel down the tree, this is the height and thickness of the trunk.

Momentum is the direction of the market before the order is placed. So in a fast rising market a trader would do well to complete his purchases early, and hold onto his sales but it is clear that these improvements would be market driven and not the traders input, they would happen with or without him being involved so we measure and adjust for them.

Reversion is about how the stock performs after the trade is completed, it is measured by comparing the final execution to the price of the asset at various points later in time and gives an indication of the pressure the trader was exerting whilst executing the order.

Everything discussed so far is about monitoring the progress of the order as a whole; this was easier when there was one primary exchange per stock. Now that there are many venues and liquidity has fragmented, more analysis is required to monitor the individual prints to measure how, when and where they get executed. Different venues have differing costs, pricing structures and liquidity profiles, thus this can help to answer the question of which venue is best for which order.

EVA, Collecting the spread and Market Impact

This is what is going on at ground level of our tree, the decisions made here reflect in the trader’s execution quality and therefore his alpha generation, incidentally this is where developing the tools for pre trade and real time TCA really start to show their effect on the end result of execution performance. The correct analysis of which venue to use (or avoid), which one more often get trades filled passively at or above the middle of the spread, and which exchanges create the least market impact (affecting reversion measurement positively) should over time guide us as to which venues should be used most if the priority is best execution.

Because decisions made here are affecting transactions in real time any “what if” analysis now also needs to be done in real time to be of any use. Real time analysis of what might happen if we change the venue, reduce the market impact or collect more of the bid/offer spread relative to our actual choice would really add value to the trading process.

Smart Order Router performance, HFT interference, Information leakage, Missed liquidity

Using our tree analogy, these are the roots, get these wrong and the strength of the whole tree is forever compromised. The SOR you use should be optimised for your order, not for the provider of the SOR. Intellectually HFT adds liquidity but investigating the data will tell you if it is adding or detracting from execution quality This may affect your selection of SOR/broker going forward.

As with all technology, this field changes quickly, for the latest developments and a personalised appraisal feel free to contact us.

© www.ergoconsultancy.com 2013

IS – Implementation Shortfall

The leaves of the tree are what you see, in the first instance this is often how the trader and the trading process are perceived. Implementation Shortfall is defined as the difference in price from the point when the decision to trade is taken to the point after the trade has been executed. Its measurement can be refined for variables such as liquidity.

VWAP – Volume Weighted Average Price

These are the branches that support the leaves, the VWAP for a period is often used to define execution quality, so executions which over or under perform the benchmark might be perceived as changing the tree's size. Even for a tree with the same number of leaves the greater area covered by a tree with better branch structure might be likened to an improvement in execution quality.

Momentum and Reversion

Essentially as we travel down the tree, this is the height and thickness of the trunk.

Momentum is the direction of the market before the order is placed. So in a fast rising market a trader would do well to complete his purchases early, and hold onto his sales but it is clear that these improvements would be market driven and not the traders input, they would happen with or without him being involved so we measure and adjust for them.

Reversion is about how the stock performs after the trade is completed, it is measured by comparing the final execution to the price of the asset at various points later in time and gives an indication of the pressure the trader was exerting whilst executing the order.

Everything discussed so far is about monitoring the progress of the order as a whole; this was easier when there was one primary exchange per stock. Now that there are many venues and liquidity has fragmented, more analysis is required to monitor the individual prints to measure how, when and where they get executed. Different venues have differing costs, pricing structures and liquidity profiles, thus this can help to answer the question of which venue is best for which order.

EVA, Collecting the spread and Market Impact

This is what is going on at ground level of our tree, the decisions made here reflect in the trader’s execution quality and therefore his alpha generation, incidentally this is where developing the tools for pre trade and real time TCA really start to show their effect on the end result of execution performance. The correct analysis of which venue to use (or avoid), which one more often get trades filled passively at or above the middle of the spread, and which exchanges create the least market impact (affecting reversion measurement positively) should over time guide us as to which venues should be used most if the priority is best execution.

Because decisions made here are affecting transactions in real time any “what if” analysis now also needs to be done in real time to be of any use. Real time analysis of what might happen if we change the venue, reduce the market impact or collect more of the bid/offer spread relative to our actual choice would really add value to the trading process.

Smart Order Router performance, HFT interference, Information leakage, Missed liquidity

Using our tree analogy, these are the roots, get these wrong and the strength of the whole tree is forever compromised. The SOR you use should be optimised for your order, not for the provider of the SOR. Intellectually HFT adds liquidity but investigating the data will tell you if it is adding or detracting from execution quality This may affect your selection of SOR/broker going forward.

As with all technology, this field changes quickly, for the latest developments and a personalised appraisal feel free to contact us.

© www.ergoconsultancy.com 2013